Estate Planning 101: A Glossary of Key Terms

Don't Speak Lawyer? Here is Your Plain-English Guide to Estate Planning Terms

Have you ever started researching estate planning, only to get bogged down by legalese? Articles and explanations can be packed with confusing terms that leave you more frustrated than informed. Don't worry, you're not alone! This post breaks down some of the most common estate planning terms you might encounter, making the process feel a little less intimidating.

-

The person named by the court to manage your estate after your death if you do not have a will.

-

The person or entity who inherits your assets through a will, trust, or other legal process.

-

The process of creating legal documents that dictate how your assets will be distributed after your death and how your affairs will be handled if you become incapacitated.

-

Your estate assets consist of everything you own: your home, your personal property, bank accounts, retirement accounts, business holdings, investment accounts, etc.

-

The person named in your will to manage your estate after your death.

-

These terms are interchangeable. They refer to the person who creates a trust and transfers assets to it. The grantor sets the terms of the trust, specifying how the assets will be managed and distributed to beneficiaries.

-

A person appointed by the court to care for a minor child or incapacitated adult.

-

When someone dies without a valid will, the state determines how their assets will be distributed according to inheritance laws.

-

Ownership of property with another person, with the right of survivorship, meaning the surviving owner automatically inherits the deceased owner's share.

-

Financial account (checking, savings, investment) owned by two or more people with the right of survivorship. Upon one owner's death, the remaining owner(s) automatically become sole owner(s) of the account.

-

A special type of deed used to transfer ownership of real property. It allows the grantor (original owner) to retain lifetime use of the property while reserving the right to sell or mortgage it. Upon the grantor's death, the property automatically transfers to the designated beneficiary named in the deed. This can be helpful for Medicaid planning purposes in North Carolina.

-

An ownership interest in real property that lasts for the lifetime of a designated person (the life tenant). The life tenant has the right to live in or use the property for the duration of their life. After the life tenant's death, ownership of the property passes to a designated remainder beneficiary.

-

A document that outlines your wishes for medical care in the event you are unable to communicate them yourself.

-

A financial account that automatically transfers ownership to a designated beneficiary upon the owner's death.

-

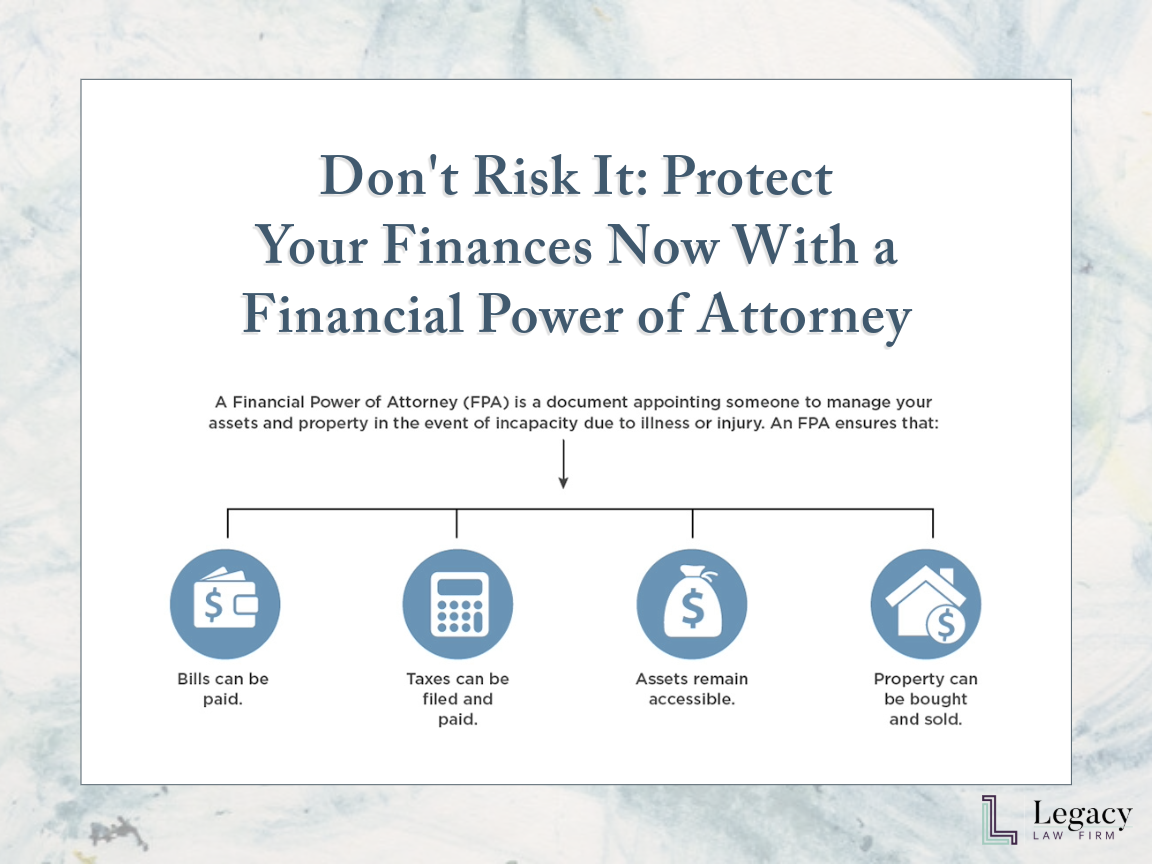

A legal document that grants another person the authority to act on your behalf regarding financial (Durable POA) or medical matters (Healthcare POA) if you become incapacitated.

-

The legal process of administering a deceased person's estate, including paying debts, settling taxes, and distributing remaining to beneficiaries.

-

A legal arrangement where you transfer assets to a trustee who manages them for the benefit of beneficiaries.

-

A trust where you transfer ownership of assets and give up control, often used for tax benefits, Medicaid planning, or asset protection.

-

A trust that takes effect during your lifetime, often used to manage assets or care for a disabled beneficiary.

-

A trust that allows you to retain control over the assets during your lifetime and make changes as needed.

-

A legal document that outlines how you want your assets distributed after your death and who will care for your minor children.

Estate planning doesn't have to be complicated. By familiarizing yourself with these basic terms, you'll be well on your way to creating a plan that protects your loved ones and secures your legacy. If you have further questions or would like to discuss your specific needs, feel free to contact Legacy Law Firm for a consultation.