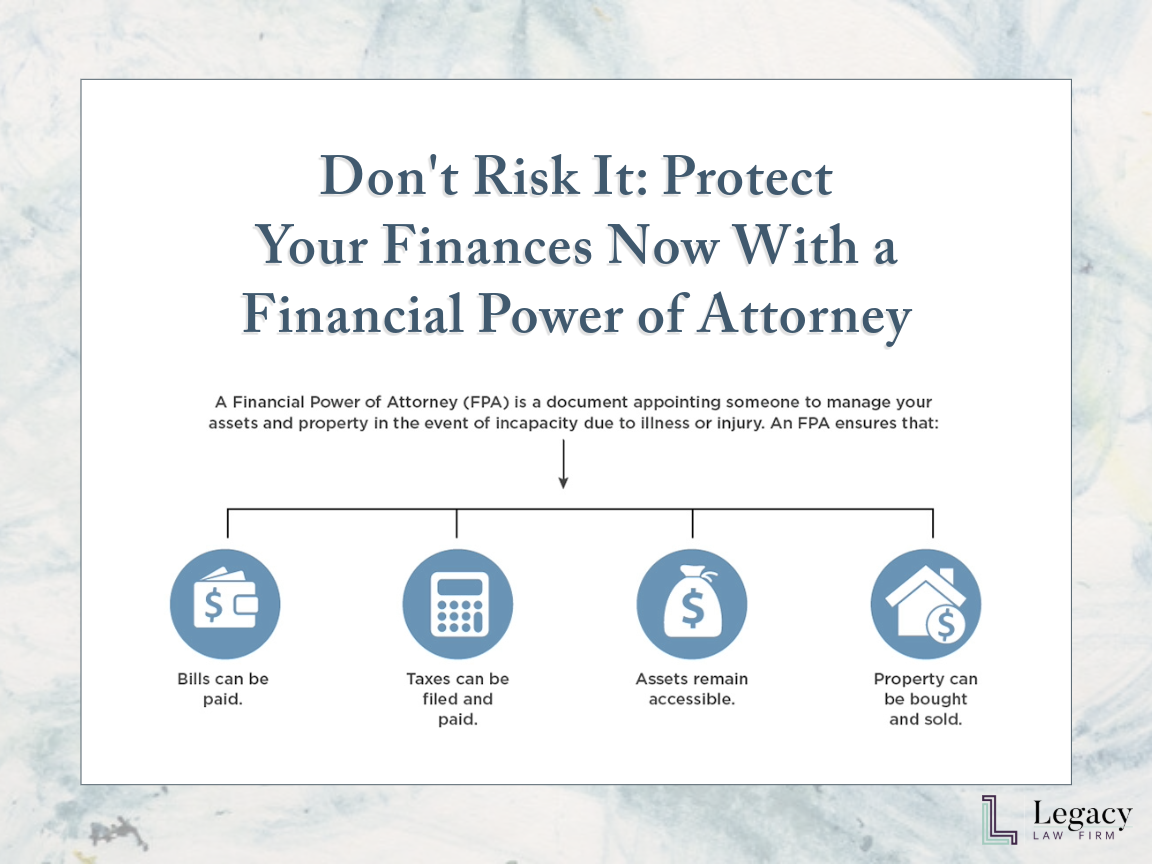

Don’t Risk it: Protect Your Finances Now with a Financial Power of Attorney

You spend a lot of your time and effort managing your finances and ensuring you are financially stable. Part of ensuring you are financially secure is ensuring that you have designated someone to manage your finances in the event you become incapacitated or are otherwise unavailable. This is accomplished through the use of a Financial Power of Attorney (FPA) also known as a Durable Power of Attorney (DPOA).

Durable Power of Attorney: what is it?

A DPOA allows you to select a trusted family member or friend who will be responsible for managing your money and other property if you become mentally incapacitated (unable to make your own decisions) due to illness or injury or are physically unavailable. Without this document, bills can’t be paid, tax returns can’t be filed, bank and investment accounts held in your name become inaccessible, retirement distributions can’t be requested, and property can’t be bought, sold, or managed. If you are an adult, no one is automatically able to act for you. For someone to act on your behalf, they must formally be granted authority, typically through the use of a DPOA. Without it, you and your loved ones could lose valuable time, money, and control if a guardianship must be sought.

What happens if I don’t have one and get sick?

If you get sick and are unable to make or communicate your financial decisions and don’t have an updated DPOA in place, a judge will have appoint a guardian to take control of your assets and make all personal and medical decisions for you through a court-supervised guardianship. This can be a lengthy and expensive process. The person seeking to become your guardian will need to file a petition with the court and attend a hearing to prove why they are the appropriate person to be appointed. The guardian will have to submit annual accountings to the court which would include detailed itemizations of your assets and all assets and expenditures made each year. Chances are, you do not want your financial details made public and a valid DPOA is how you prevent it.

WORD OF CAUTION: Don’t think you’re protected just because your assets are held jointly with your spouse, child, or family member. These are a few reasons why you shouldn’t just rely on joint ownership:

Limited power. While a joint account holder may be able to access your bank account to pay bills or access your brokerage account to manage investments, a joint owner of real estate will not be able to mortgage or sell the property without the consent of all other owners.

Tax liability. By adding a family member’s name to your accounts or real estate titles you might be saddling them with gift tax liability.

Property seizure. You read that correctly. If your joint owner incurs certain debts, in certain situations the property could be ordered to be sold to pay their debts.

Medicaid disqualification. Putting a loved one’s name on a joint bank account or property title can disqualify them from receiving government benefits, such as Medicaid.

Only a comprehensive incapacity inclusive estate plan will protect you and your assets from a court-supervised guardianship or unintended consequences by using joint ownership. Do not rely just on joint ownership as your plan—it’s risky and unreliable.

Already have a Power of Attorney?

While a DPOA is generally effective until the grantor dies or revokes the DPOA, some third parties are of the opinion that a DPOA can become “stale” in as short as one year. It is becoming increasingly common for financial institutions to refuse to rely on an outdated DPOA. Depending on your circumstances, a stale power of attorney would prevent your designated agent from managing your insurance contracts, retirement plans, banking and investment accounts, online personal accounts such as email, Facebook, Instagram and LinkedIn, and elder care and special needs planning.

If it’s been more than a year or two since you’ve signed your power of attorney, we’d recommend executing a new one to minimize the risk of a financial institution refusing to honor it.

Unsure of what to do? Legacy Law Firm can help.

If you are uncertain about who would be the best person to serve as your DPOA, how much authority you should grant your DPOA, or when to make you DPOA effective, Legacy Law Firm is here to help walk you through these decisions.

Don’t wait until it is too late to ensure your finances are protected if you become incapacitated or are otherwise unavailable.